Effective Execution Delivering Strong Sales and Earnings Growth Despite COVID-19 Operational Challenges

25 August, 2020 – Ansell Limited (ASX:ANN), a global leader in safety solutions, today announces full year results for the period ending 30 June 2020.

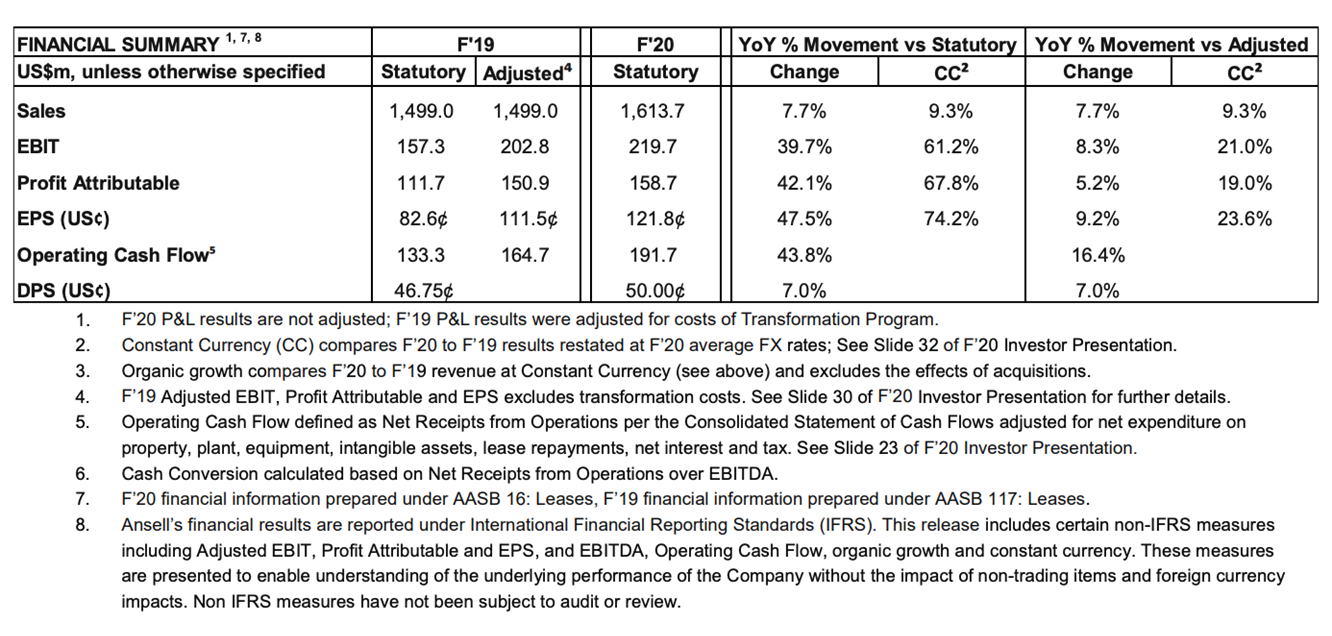

Results1 Highlights (Please note all amounts in this release are reported in US dollars)

- Sales of $1,613.7m; 7.7% growth, 9.3% Constant Currency (CC)2 and 7.6% organic growth3

- Healthcare organic growth3 of 13.4%, strong performance entering F’20 H2 was further accelerated by COVID-19 related demand, particularly for Exam/Single Use products

- Industrial organic growth3 of 1.3%, modest growth despite severely impacted macro backdrop. Increased demand for Chemical Protective Clothing and Gloves more than offset softness in Mechanical

- EBIT of $219.7m, up 8.3% YoY and 21.0% on a CC basis vs F’19 Adjusted EBIT4

- Driven by sales growth, transformation benefits and net favourable raw material costs. Partly offset by adverse FX movements and increased manufacturing costs due to government mandated plant shutdowns and other COVID-19 costs.

- Profit Attributable of $158.7m, up 5.2% YoY and 19.0% on a CC basis vs F’19 Adjusted Profit Attributable4

EPS of US121.8¢, up 9.2% YoY and 23.6% on CC vs F’19 Adjusted EPS4 due to strong EBIT growth and share buyback - Strong Operating Cash Flow generation of $191.7m5 with Cash Conversion of 117.7%6

- Increased full year dividend to US50.0¢, an increase of 7.0%, final dividend US28.25¢

Comments by Ansell Chairman, John Bevan

“F’20 was an unprecedented year for the global economy but also for the Company. Despite operational challenges caused by COVID-19, Ansell was able to deliver a high quality financial result with strong growth in sales and earnings combined with robust cash flow generation and improved return on capital employed. The Company has delivered EPS at the top end of its guidance range. This demonstrates not only the successful execution of the company’s strategy but also resilience of the business, reflecting the breadth of its portfolio and the balance of products, end- users and geographies.

Our balance sheet remains strong with liquidity of ~$605m comprised of cash and committed undrawn bank facilities available at 30 June 2020. Given ongoing uncertainties in the market, we considered it was prudent to pause our share buyback program at the end of March 2020. Prior to this, we had purchased 3.8m shares at a cost of $67.9m during F’20. We are pleased to deliver another year of increased dividends, the 17th year in a row, declaring a final dividend of US28.25¢ which takes our full year dividend to US50.0¢, a 7% increase compared to the prior year.

Given the uncertainties introduced by COVID-19 as well as international travel restrictions, the Board has decided to postpone two critical changes to the Board and Management succession plans. Specifically (i) Marissa Peterson agreed to defer her retirement by one year until the F’21 Annual General Meeting; and (ii) Magnus Nicolin agreed to delay his retirement and stay with the company for a further six months, until 31 December 2021.

The Company is well prepared to continue to negotiate challenges presented by COVID-19 and the dramatic effects the virus is having on economic growth worldwide. Our safety practices remain at a high level. Our increasing manufacturing capabilities and capacities will allow us to support an expanded demand situation. Furthermore, our 800 strong global sales force, improving digital capabilities and market leading brands positions us well to gain further market share and demonstrate industry leadership during the challenging times.”

Business Review – Comments by Ansell CEO and Managing Director, Magnus Nicolin

“The safety, health and well-being of our people has been our number one priority throughout the pandemic. We have implemented strict protocols around the world to protect our employees, particularly at our manufacturing and distribution facilities. I am encouraged that only a small number of colleagues from our ~13,500 strong global workforce have tested positive to COVID-19 and that they have recovered or are recovering well.

I am pleased to say that during the pandemic, Ansell has strengthened its position as a global leader in the PPE sector. A number of our products are being used in the fight against COVID-19, particularly our Exam & Single Use Gloves along with Chemical Protective Clothing which have been tested and certified to recognised standards for protection from infective agents. I am extremely proud of the resourcefulness and dedication of our employees who have adapted well to the new working environment. They have worked hard to optimise and expand our operations to ensure products get to the end customers. This was often in the face of significant challenges such as temporary government orders that enforced partial and full shutdowns of our manufacturing operations in Malaysia and Sri Lanka in March/April, temporary shutdowns of warehouses as well as reduced freight capacities.

Our strategy expressed in our Eight Dimensions of Differentiation has served us extremely well. We have built a specialist global manufacturing company, well-grounded in numerous capabilities, with a uniquely broad and balanced range of high-quality, complementary personal protection products. Our portfolio gives us the flexibility to deal with shocks and move resources from one business unit to another. All of these factors contributed to our strong response to the COVID-19 crisis and reaffirmed the strategy.

We remain committed to continuing to invest in the business to support long-term sustainable growth. Following increased demand for a number of our products, we were able to increase manufacturing capacity of our Chemical Protective Clothing at China (Xiamen) and Sri Lanka by more than 40% compared to pre COVID-19 levels. We are in the process of expanding capacity further at those plants. In addition, we are localising production in Brazil and Lithuania. We are also working hard to complete the expansion commenced at our Thailand plant in October 2019 which will increase our internal manufacturing capacity of single use gloves by ~35%.

A comparison with our experience during the Global Financial Crisis in 2009 underlines how Ansell has evolved over the last ten years. At that time, the Company was much more dependent on Mechanical glove categories and other traditional products. The extraordinary demand for supply this year has been in Exam/Single Use which we have tripled in size following several acquisitions in recent years as well as Life Science and Body Protection, neither of which formed part of our portfolio ten years ago.

Ansell remains committed to leading the PPE and Healthcare industries in terms of sustainability and labour practices in relation to our own plants and we continue to work closely with our suppliers to ensure appropriate labour standards are being employed throughout our supply chain.”

Global Business Unit Performance

Healthcare GBU – 55.4% of revenue and 60.5% of Segment EBIT

F’20 sales were $894.6m, representing growth of 13.8% in constant currency terms and 12.5% on a reported basis. This included a full year contribution from Digitcare, which was acquired 31 October 2018. Organic growth for the year was up 13.4%. The business entered F’20 H2 with strong momentum which was further accelerated due to COVID-19 related demand, particularly for Exam/Single Use products.

Exam/Single Use experienced organic growth of 18.2%, where COVID-19 significantly increased market demand which is expected to continue for at least another 12 months. The market imbalance has led to certain industry players significantly increasing their prices. As a result, Ansell is having to pass through price increases for some outsourced products. Pricing is expected to remain dynamic through F’21. The actions taken in relation to Surgical in the last few years with respect to salesforce and geographic focus and capacity investments have allowed the business to deliver solid organic growth of 4.1%, albeit this was adversely impacted in F’20 Q4 due to the postponement of elective surgeries. Life Science continued to expand due to major account wins and increased market share in North America, leading to organic growth of 16.3%

EBIT in constant currency was 34.7% higher than the prior year. This was due to higher volumes, pricing initiatives, net favourable raw material costs (whereby nitrile more than offset increases from outsourced suppliers in Q4) as well as improved manufacturing performance. These were partly offset by COVID-19 related costs. Currency was a negative headwind, and on a reported basis, EBIT was up 23.0%.

Industrial GBU – 44.6% of revenue and 39.5% of Segment EBIT

F’20 sales were $719.1m, an increase of 4.2% in constant currency and 2.2% on a reported basis. This included a full year contribution from Ringers, which was acquired on 1 February 2019. Organic growth was up 1.3% and at similar levels in both F’20 H1 and F’20 H2. However, the trend differed between Mechanical and Chemical due to the impact of COVID-19.

Mechanical organic growth declined 2.0%, with F’20 H2 declining 4.6% compared to F’20 H1 growth of 0.5%. Despite strong performance from the multi-purpose portfolio, the mechanical business experienced a decline due to the slowdown in economic activity resulting from forced shutdowns as a result of COVID-19. The business has started to pivot to higher growth verticals and reposition existing as well as launch new products to meet needs in a COVID- 19 environment i.e. antiviral and antimicrobial. Chemical grew 7.9%, with F’20 H2 growth of 12.6% compared to F’20 H1 growth of 3.0%. COVID-19 elevated demand for our Alphatec® Chemical Protection Clothing which saw growth of 31.8% in F’20 H2. Ansell has invested in increasing capacity to meet demand for Chemical Protection Clothing and will continue to invest in F’21.

EBIT in constant currency terms increased 7.0% compared to the prior year. The business benefited from increased volumes, pricing initiatives and the Transformation Program. However, these were partly offset by product mix, increased labour as well as COVID-19 related costs. Currency was a negative headwind driving reported EBIT down 6.4%.

Currency, Cash Flow and Balance Sheet

The net impact of currency movements during the period was unfavourable to revenue and EBIT by $22.6m and $14.8m respectively. This was primarily due to the weakening of the Euro vs USD, which has a higher revenue than cost contribution and strengthening THB vs USD which is predominately a cost currency. In addition, F’20 net foreign exchange gain was $0.5m vs the prior year of $6.8m.

Ansell delivered strong operating cash flows of $191.7m and cash conversion of 117.7%. Operating cash flow was 16.4% higher than the prior year’s adjusted operating cash flow of $164.7m due to increased profitability and working capital inflow. This was partly offset by higher capex as the company continued to invest in projects for growth and profitability improvements.

The share buyback program was paused in late March 2020 with a view to conserve liquidity given increased uncertainties in the global economy. Prior to this, Ansell purchased 3.8m shares on market at a cost $67.9m.

Ansell continues to maintain a strong balance sheet position with a conservative gearing profile and has access to significant liquidity with no major debt maturities in the next 12 months.

Dividend

A final dividend of US28.25¢ per share has been declared (US26.0¢ F’19). The record date will be 1 September 2020 and the payment date 17 September 2020. This takes total dividends for the full year to US50.0¢, an increase of 7.0% on the prior year. For non-Australian resident shareholders, the dividend will not attract withholding tax as it is sourced entirely from the Company’s Conduit Foreign Income Account.

Dividend Reinvestment Plan (DRP)

The DRP will be available to resident shareholders of Australia, New Zealand and the United Kingdom with an election cut off date of 2 September 2020. The pricing period will be based on the trading days commencing 4 September 2020 and ceasing on 10 September 2020. No discount will be available.

F’21 Outlook

The impact of COVID-19 on the global economy and the markets in which Ansell operates continues to evolve. Although we cannot predict the severity of COVID-19 around the world, we do expect it to remain a challenge through F’21 and possibly into F’22 as well. We believe the Company is well positioned to continue to respond and adapt. We have a well-balanced portfolio with strong brands that served us well in F’20 and are expected to do so in the future.

The Exam/Single Use industry is expected to continue to see significant supply shortages which are likely to result in increased costs from outsourced suppliers. As a result, our sales pricing will continue to be dynamic. These costs are expected to be recovered, however it is likely that EBIT margin will be negatively impacted due to cost pass through.

The outlook for our Strategic Business Units is expected to remain mixed throughout F’21, with strong growth in Exam/Single Use, Chemical, Surgical and Life Science, tempered by weakness in Mechanical. We expect organic growth to be substantially higher than the 3-5% long term target levels driven by price and volume increases. Given increased demand for a number of our products, we will continue to invest further to increase capacity but also continue to focus on automation to drive efficiencies. We expect F’21 capital expenditure to be $95-105m.

Net interest expense is anticipated to be in the range of $19.5m-$20.5m, higher than the previous year mainly due to lower rates on cash invested. The effective tax rate is expected to be higher at 22.0-23.0%.

Based on the above drivers, we expect F’21 EPS to be in the range of 126¢ to 138¢. The Company acknowledges that the COVID-19 situation is constantly evolving and presents significant uncertainty. The EPS range reflects the uncertainties from raw material pricing, foreign exchange, the ability to increase Exam/Single Use prices as needed and finally our ability to increase supply of critically needed products.

This announcement was authorised for release by the Board of Directors of Ansell Limited.

ENDS