16 February 2021 – Ansell Limited (ASX:ANN), a global leader in personal protection safety solutions, today announces half year results for the period ending 31 December 2020.

Results Highlights (Please note all amounts in this release are reported in US dollars)

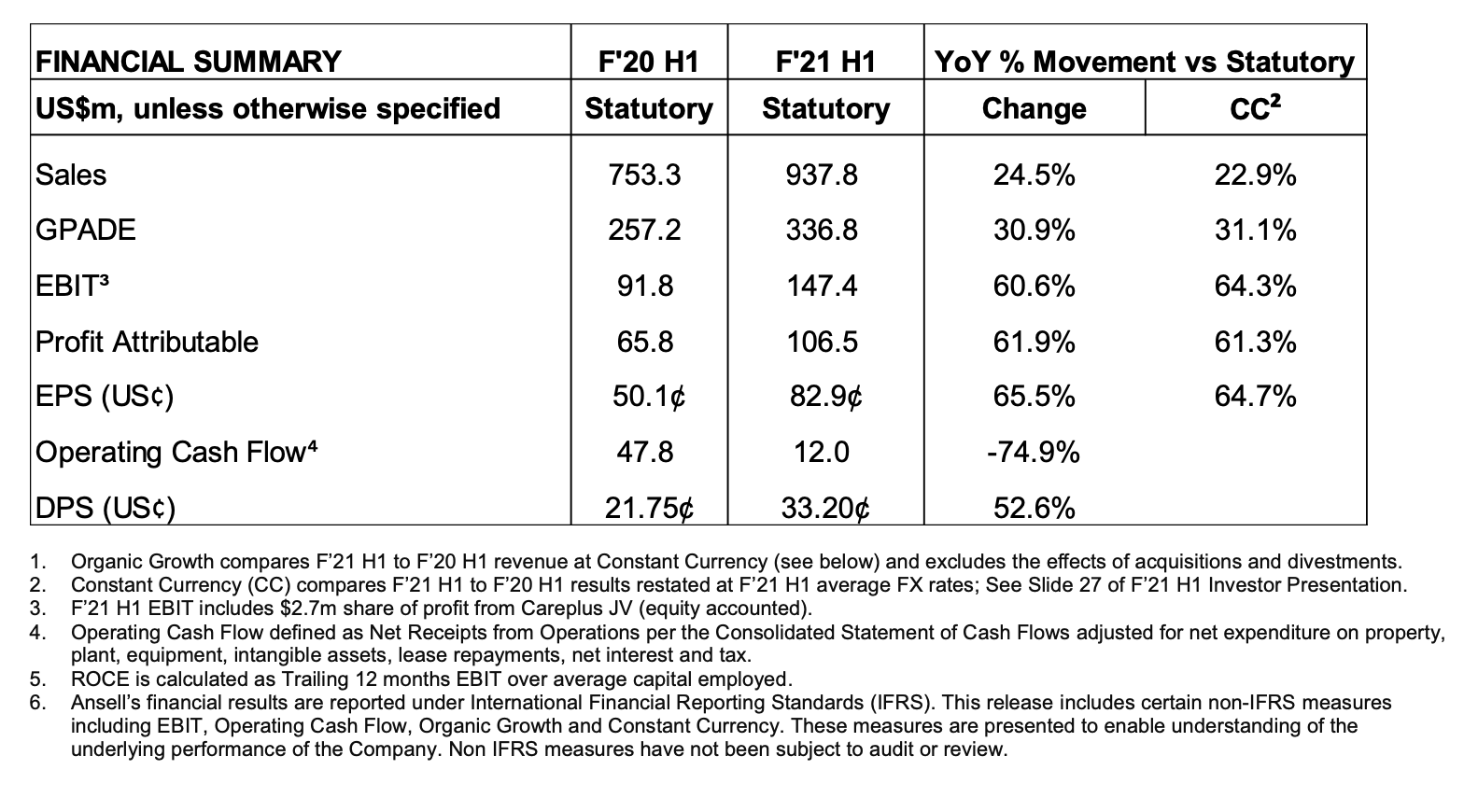

- Sales of $937.8m; 24.5% growth and 22.9% Organic Growth1 (Volume +12.3% and Price/Mix +10.6%)

- Healthcare Organic Growth1 of 37.3% with strong volume growth across all Strategic Business Units (SBUs) and favourable price/mix impact, mainly in Exam/Single Use (SU)

- Industrial Organic Growth1 of 7.0% with strong volume growth from Chemical Protective Clothing and Multi-Purpose/Electrical/Cut gloves more than offsetting weaker demand from Impact gloves

- EBIT3 of $147.4m, up 60.6% YoY and 64.3% on a Constant Currency growth (CC)2 basis. EBIT margin improved by 353bps to 15.7%

- Driven by sales growth combined with higher production volumes, manufacturing efficiencies and SG&A operating leverage

- Profit Attributable of $106.5m, up 61.9% YoY and 61.3% on a CC basis and EPS of 82.9¢, up 65.5% YoY and 64.7% on CC basis

- Operating Cash Flow generation of $12.0m4 reflects increased investment in working capital to support sales growth and higher capital expenditure to expand capacity to meet greater demand while achieving ROCE of 16.3%5

- Increased half year dividend to US33.2¢, 52.6% growth over F’20 H1 and ~40% dividend payout. Targeting to pay between 40-50% of Profit Attributable to Ansell’s shareholders as dividends

Comments by Ansell Chairman, John Bevan

“The first half of 2021 financial year continued to be dominated by the impacts of COVID-19, whether it was the need to ensure the safety of our employees, increased demand for enhanced personal protective equipment by end-users or the flow-on effects of lockdowns on the global economy. The company was able to successfully navigate through these to deliver record organic sales and constant currency earnings per share growth of 22.9% and 64.7%, respectively.

Our balance sheet remains strong. We have focused our cash deployment towards investing in working capital to support top-line growth and expanding capacity to meet customer requirements in high demand areas. This helped to drive a 304bps improvement to ROCE. Despite the large levels of investment, we maintain a low leverage of 0.7x net debt/EBITDA and ~$560m of liquidity as at 31 December 2020.

Following a recent review of Ansell’s capital management policy, the Board decided to move to a proportional dividend policy, targeting a payout ratio of 40-50%. This approach is expected to better align shareholder benefits with movements in earnings but also provide the ability to support investment in future growth and maintain a strong balance sheet. As a result, we are pleased to declare an interim dividend of US33.2¢ per share which represents 52.6% increase compared to the prior year and 40% payout ratio.

The Board continues to meet virtually but is making good progress in relation to Board and CEO succession planning and expects to be able to provide an update to the market during F’21 full year results release.”

Business Review – Comments by Ansell CEO and Managing Director, Magnus Nicolin

“Our half year performance demonstrated once again the strength of our strategy expressed in our Eight Dimensions of Differentiation. In particular, our focus on manufacturing capabilities, strength of our brands and product as well as broad customer coverage has served us well. We were able to deliver better than expected growth across all of our strategic business units. Exam/SU, Life Sciences and Chemical saw stronger performance partially driven by COVID- 19 whilst Surgical and Mechanical SBU’s were able to demonstrate favourable performance and market share gains despite facing industry headwinds.

Our capacity expansions are progressing well despite the challenges of operating in a COVID-19 environment. During the first half, we started five new production lines and expect another eight production lines to go live during the second half. This is an unprecedented expansion of capacity for Ansell and reflects a strategy to better meet increased demands but also control our destiny in terms of supply and improved sustainability practices. By F’22- F’23 we expect to have more than doubled our in-house capacity of single use gloves and suits and will also have expanded capacity in Surgical, Multi-Purpose, Chemical and Electrical gloves to be able meet the stronger demand from our customers for Ansell branded products.

We are confident we can secure strong returns on these investments. We expect that COVID-19 will continue to impact the world for some time and once the pandemic is under control, elevated demand for our products is likely to persist, whether due to enhanced safety practices at plants and hospitals, better protection awareness in emerging markets, more research & testing activities worldwide or the potential need for annual COVID-19 vaccinations.

The safety of our employees remains our key priority and in particular, those at our manufacturing sites and distribution centers. We continue to introduce new measures to further protect our workers including random and rolling COVID-19 tests and zoning of employees by location to minimise risk of cluster formation. We are also working with our suppliers to ensure alignment on employee standards and safety in a COVID-19 environment.

In this very dynamic year, we have a lot to thank our global workforce for. They have been superbly committed and passionate about delivering the protection solutions the world needs, and I thank them.”

Global Business Unit Performance

Healthcare GBU – 58.6% of revenue and 63.4% of Segment EBIT

F’21 H1 sales were $594.7m, representing 39.2% reported growth and 37.3% Organic Growth. The business saw strong volume growth across all SBUs and even stronger price/mix impact mainly due to effective pass through of cost increases in Exam/SU but also pricing initiatives as well as favourable product and customer mix.

Exam/SU experienced Organic Growth of 47.5%. Market demand remains elevated due to COVID-19 where volume growth was capped by supply. The supply and demand imbalance has resulted in continuing cost increases from outsourced suppliers. However, we have been able to effectively pass through these cost increases as price increases. This action in addition to other pricing initiatives and favourable mix helped to contribute to the strong Organic Growth. Life Science delivered Organic Growth of 32.3% as it also continued to benefit from COVID-19 and the impact of major account wins from F’20 H2. Surgical & HSS produced Organic Growth of 19.6% which was predominately volume driven due to high demand from existing customers, our ability to pick up sales from competitors and the products being used outside of the surgical setting.

EBIT on a reported basis was 83.9% higher than the prior year and margins improved 444bps to 18.3%. This was due to favourable impact from stronger sales as a result of volume and price increases, plants running at full capacity with high overhead absorption combined with operating efficiencies and SG&A operating leverage. These positive movements more than offset increased costs for improved CSR and COVID-19 safety practices. Careplus JV (equity accounted) share of profits contributed $2.7m income.

Industrial GBU – 41.4% of revenue and 36.6% of Segment EBIT

F’21 H1 sales were $388.1m, an increase of 7.0% in constant currency and 8.3% Organic Growth. The business saw strong volume growth from Chemical Protective Clothing as well as Multi-Purpose, Electrical and Cut gloves which more than offset weakness from Impact gloves. The price/mix impact was negative where price increases were more than offset by stronger growth from lower priced products.

Mechanical Organic Growth declined 1.0%. This was a good performance from the business given the economic backdrop and was made possible due to portfolio and vertical diversification. Multi-Purpose and Electrical gloves continued to see strong demand due to higher activity and market share gains from warehousing & logistic and utilities sectors. Cut volume growth was positive. This more than offset weaker Organic Growth from Impact due to lower activity in oil & gas sectors. Chemical experienced 21.8% Organic Growth of which Chemical Protective Clothing saw 69.4%. Our recent capacity investments enabled our ability to meet continued growth of the business due to higher demand from COVID-19 but also helped to reduce backorders. Chemical glove growth was modest with upside from food processing and janitorial & sanitation offset by lower petrochemical and industrial demand.

EBIT on a reported basis increased 30.4% higher than the prior year and margins improved 253bps to 14.9%. This was due to favourable impact from stronger sales as a result of volume and price increases, plants running at stronger capacity with high overhead absorption combined with SG&A operating leverage which more than offset adverse mix impact and increased costs for improved CSR and COVID-19 safety practices.

Currency, Cash Flow and Balance Sheet

The net impact of currency movements during the period was favourable to revenue and EBIT by $10.0m and $1.7m respectively. This was primarily due to a general trend of USD weakness with improvement of EURUSD a key driver. F’21 H1 net foreign exchange loss was $3.7m compared to F’20 H1 net foreign exchange gain of $1.5m.

Ansell delivered operating cash flows of $12.0m and cash conversion of 71.2% after adjusting for incentive and insurance payments which were paid in H1 but relate to the full year. Operating cash flow was temporarily weaker due to greater investment in working capital to support top line growth and higher capital expenditure to increase capacity in a number of our higher demand products, including Single Use, Surgical, Multi-Purpose and Rubber Insulating gloves (RIG).

Ansell continues to maintain a strong balance sheet position with a conservative gearing profile (net debt/EBITDA of 0.7x) and has access to significant liquidity with no major debt maturities in the next 12 months.

Dividend

An Interim Dividend of US33.2¢ (US21.75¢ F’20 H1) per share has been declared. This is a 52.6% increase on the prior year and represents ~40% payout ratio. Following a recent review of its capital management policy, the Board has decided to move to a proportional dividend policy, targeting to payout 40-50% of Profit Attributable to Ansell’s shareholders. This approach is expected to better align shareholder benefits with movements in earnings, and also to support investment in future growth by preserving a strong balance sheet. The Board intends to supplement dividends with on-market buybacks from time to time as and when appropriate to distribute surplus capital. The record date will be the 23 February 2021 and the payment date will be 10 March 2020. For non-resident shareholders, the dividend will not attract withholding tax as it is sourced entirely from the Company’s Conduit Foreign Income Account.

Dividend Reinvestment Plan (DRP)

The DRP will be available to resident shareholders of Australia, New Zealand and the United Kingdom with an election cut off date of 24 February 2021. The pricing period will be based on the trading days commencing 26 February 2021 and ceasing on 4 March 2020. No discount will be available.

F’21 Outlook

Our expectations are that COVID-19 will continue to impact the world for some time. Assuming the pandemic is under control towards end of F’22, GDP growth will accelerate further and depressed sectors such as automotive, oil & gas and transportation will return to growth while hospitals return to normal operations to manage down the pent up demand for surgeries and other procedures.

We expect to see strong demand for PPE for the next twelve months. Even when 70% of the population is vaccinated, elevated demand for most of our products will continue due to (a) enhanced safety practices at plants and hospitals; (b) better protection awareness with increased glove use per capita (particularly emerging markets); (c) elevated research & testing activities worldwide; (d) potential need for annual COVID-19 vaccinations; and (e) improving industrial activity.

The Exam/SU industry is expected to continue to see supply/demand imbalance. As a result, outsourced supplier costs and NBR (Nitrile) raw material costs will increase, which we will look to pass on to customers. We expect to see elevated demand for many of our other products i.e. Chemical, Surgical, Life Science and Mechanical. However, there is a high likelihood that supply may be temporarily disrupted due to COVID-19 spikes at factories (our own and outsourced suppliers) and worsening shipping conditions and container availability.

Net interest expense is anticipated to be in the range of $19.5m-$20.5m. The effective tax rate is expected to be 22.0-23.0%.

Based on all of the above drivers, we are revising our EPS guidance for F’21 to be in the range of 160¢ to 170¢.

Webcast

Magnus Nicolin (Managing Director and Chief Executive Officer) and Zubair Javeed (Chief Financial Officer) will host a webcast at 8:00am Australian Eastern Daylight Time on Tuesday, 16 February 2021 (equivalent to 10:00pm Central European Time and 4:00pm Eastern Standard Time 15 February 2021) to discuss the results.

To listen to the webcast, please visit Ansell’s Investor Relations website www.ansell.com/au/en/about-us/investor-center/webcast. Alternatively, please click on the following link https://onlinexperiences.com/Launch/QReg/ShowUUID=81F2E4B6-2C31-4CC5-9652-C7EC6E04E203&LangLocaleID=1033.

This announcement was authorised for release by the Board of Directors of Ansell Limited.

ENDS