Improved second half delivers constant currency EBIT growth, increased dividend

15 August, 2016 – Sydney, Australia – Ansell Limited (ASX: ANN), a global leader in protection solutions, today announces full-year results for the 12-month period ending 30 June 2016.

Please note all dollar amounts in this release are reported in US dollars

Results Highlights

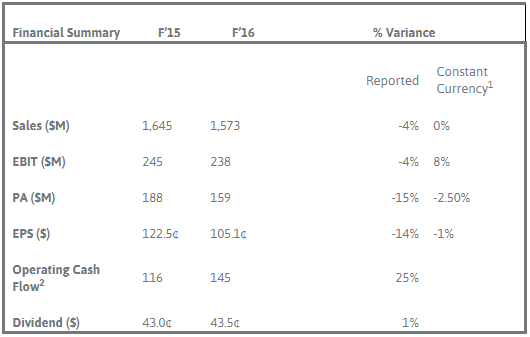

- Reported sales at US$1,572m down 4% YoY, but in line with F’15 in constant currency1

- EBIT of $236.7m down 4% YoY, but up 8% in constant currency

- EPS at $1.05 down 14% YoY, down 1% in constant currency

- Continued good performance of growth brands in Industrial & Single Use, strengthening in 2H

- Strong EBIT growth in Sexual Wellness and Single Use

- Medical affected by weak emerging markets and short term operations variances

- Operating Cash Flow2 $145m, up 25% on previous year’s $116m

- Increased full year dividend up 1.2% to US43.5¢. Final dividend of US23.5¢

1Constant currency compares F’16 results to F’15 results restated at F’16 average exchange rates and excluding variance related to currency hedging programme. (See slide 43 of F’16 Investor Presentation for additional information.

2Operating Cash Flow means net cash provided by operating activities per the Consolidated Statement of Cash Flows adjusted for net expenditure on property, plant, equipment , intangible assets and net interest.

Chairman Glenn Barnes’s Comment

“As expected, F’16 proved to be a challenging year due to a continuing weak global economy and currency fluctuations. Nevertheless, we continued to make progress against our strategic priorities and again demonstrated the strong cash generating characteristics of our businesses. We delivered results in line with guidance and the Company maintains a strong balance sheet with good liquidity. This has supported another increase in the full year dividend, a consistent trend that Ansell is very proud of.”

Business Review – Comments by CEO and Managing Director Magnus Nicolin

“While overall our F’16 results were at the low end of our original guidance, we nevertheless made significant progress particularly in the second half, delivering against all the key priorities we outlined mid-year. Our growth brands in Industrial, Single Use and Sexual Wellness continued to outperform the market, gaining share through the success of new product launches and continued progress in developing stronger distributor partnerships.

“Results in emerging markets were strong for Sexual Wellness and generally improved through the year for Single Use and Industrial, with continued strong performance in China and Mexico while it was encouraging to see a return to growth in Russia for Industrial in the second half.

“The Medical business has made significant progress in addressing the first half manufacturing issues. Our new synthetic surgical lines were completed on schedule at year end and have proceeded smoothly through commissioning and commercial validation. We have also addressed the first half start up issues on the new line in Melaka and costs are now trending back to benchmark levels. Emerging market conditions for medical remained challenging in the second half although we see improving trends as we begin F’17.

“New Intercept® yarn based products have been the highlight of our recently released new products. We achieved sales of $15m on this range in the first full year of launch, one of our most successful product launches ever. We also achieved encouraging success in growing our recently acquired product ranges, extending the Microflex® range globally and continuing to grow our Medical Healthcare Safety Solutions range at a healthy rate. Our Sexual Wellness business also achieved significant growth through extensions to the SKYN® range, which now includes an offering of premium lubricants.

“We divested the US only Onguard® boots business in May after deciding to focus our resources on the recently acquired Microgard® clothing business, which we believe, has significant potential to expand globally, including in markets where it has not historically had a major presence.

“The progress we are now achieving, against key components of our strategy, gives me confidence that our priorities are correct and with continued and improved execution we can deliver enhanced organic growth, profitability and cash flow. The multi-year success of growth brands is strong evidence of this, and as our program of product rationalization concludes we are, as expected, seeing a reduced negative drag from older products.

“Overall, achieving 8% constant currency EBIT growth in challenging market conditions was a solid result and cash flow was strong, especially as we continued to fund many capex and development programs that are important to our long-term success and for value creation for shareholders.“

Underlying Global Business Unit Performance

All percentages quoted, except where otherwise indicated, refer to constant currency variances vs the prior comparative period.

Industrial GBU - 42% of revenue and 38% of Segment EBIT

Sales increased by 3.3% and EBIT 10.1% assisted by the Microgard acquisition.

Sales in emerging markets improved 5% for the year with China, Eastern Europe and Mexico all up and Russia also improving. HyFlex®, one of our growth brands, was up 5%. New product sales were up 42% YOY with the Intercept® range performing ahead of expectations. Microgard® has largely been integrated and exceeded expectations to date.

The EBIT margin was marginally lower YOY as a result of a temporary $6m increase in manufacturing cost that arose in Mexico during the year, but has now been resolved.

Single Use GBU - 19% of revenue and 27% of Segment EBIT

Generated strong EBIT growth up 14.9% on relatively stable sales which were slightly lower by 1.1%.

Sales volume growth was offset by price reductions as the benefit of lower raw material input prices were passed onto customers. Both the Microflex® and TNT® brands grew strongly with combined revenue up 2% and volume up 5%. This was based on a successful global launch of key Microflex® products, while the Edge® brand has grown quickly in emerging markets. Innovation remains the main driver with the launch of a new chemical resistant glove receiving strong customer interest.

EBIT margin improved on the back of raw material input price reductions along with diligent cost controls and the delivery of BSSI integration synergies.

Medical GBU – 25% of revenue and 22% of Segment EBIT

Revenue fell 8.3% with EBIT 17.5% lower.

Sales were lower due to supply constraints limiting growth in the fast growing synthetic surgical range. This was compounded by weak emerging markets partly on constrained public healthcare expenditure and price pressure in examination gloves.

EBIT was lower on the sales decline and adversely impacted by high factory waste and lower throughput from temporary manufacturing issues, which increased costs for the year by $9m.

Sexual Wellness GBU – 14% of revenue and 13% of Segment EBIT

Revenue grew in constant currency by 8.2% and EBIT 41%.

The SKYN® brand grew 12% on success with lubricants and continued share gain by our leading non-latex condom range. Our natural rubber latex brands also performed well, up 10%, with emerging markets growing strongly (China up 28% on e-commerce success, and India’s branded business up 13%).

The EBIT:Sales margin grew from 12% to 14% based on success in the emerging markets and with the globalisation of new products. Increased investment in marketing activities was more than offset by reduced overheads and productivity gains in manufacturing and distribution.

Acquisitions & Divestments

During the year Onguard®, our footwear protection business, was sold for $41.6m realizing a profit on sale of $8.1m before tax ($2.2m or 1.4c per share after tax). As previously communicated, this divestment will be dilutive to F’17 EPS by 2.2c.

Currency, Cash Flow and Financing

Currency played a major part in the weaker F’16 results with revenue currencies including the Euro, Australian dollar and Canadian dollar all devaluing YOY creating a $70m negative impact on Sales. There was some offset to this in generally weaker cost currencies in the year including the Malaysian Ringgit, Sri Lankan Rupee and Mexican Peso. The net currency effect on EBIT (before considering the impact of currency hedges) was a negative impact of $5m. The currency hedging programme created a significant gain of $22.6m in F’15 as hedges were put in place at the generally more favourable rates available in F’14. In F’16 the hedge programme generated a neutral outcome as hedge gains on revenue currencies were offset by hedge losses on cost currencies. The year over year impact of the hedge programme was therefore a decline of $22.6m with the total currency impact on EBIT being unfavourable by $27.6m. Absent any further major movements in FX rates in F’17, the FX impacts on Revenue and EBIT are anticipated to be broadly neutral for F’17 vs F’16.

Ansell again demonstrated its ability to generate strong cash flow. The Company delivered Operating Cash Flow of $144.8m up from $116.4m in F’15. A slightly lower EBITDA was offset by an $11.8m reduction in working capital due to lower inventory and trade debtors. We continued to invest at an elevated rate in capital expenditure particularly in projects targeting productivity benefits in manufacturing and supply chain, and growth investment to support Industrial’s new products and to resolve the capacity constraint in the Medical business.

The balance sheet remains strong and the company has excellent liquidity levels. Net Debt to EBITDA was 1.54x at 30 June, 2016 even after spending $88.1m on buying-back 6.366m shares.

Dividend

The Board has declared a final dividend of US23.5¢ per share unfranked, up 2.2% (US23¢ in F’15). The record date is 22 August, 2016 and the payment date 8 September, 2016. This, when added to the interim dividend, results in a full year dividend of US43.5¢ representing a 1.2% increase over the full year dividend of F’15 of US43¢.

For non-resident shareholders, the dividend will not attract withholding tax as it is sourced entirely from the Company’s Conduit Foreign Income Account.

The Dividend Reinvestment Plan (DRP) will again be available to shareholders with no discount. The DRP election cut-off date will be 23 August, 2016.

F’17 Outlook

Success with growth brands, new products and the ongoing strength of our market positions gives us confidence that over the next 2 to 3 years we will realize our medium term goal of organic revenue growth in the low to mid single digits even in a low growth economic environment. Our continued investment in productivity while leveraging Ansell’s global scale should drive profit growth in the mid to high single digits supporting continued strong cash generation and improvement in returns on capital for the base business.

In F’17, we expect to make significant progress towards these mid-term goals, with organic growth targeted at 2% to 4%, and an underlying improvement in EPS of 2% to 17%. Reported EPS growth will be moderated by the effect of the Onguard divestment in F’16 (a 1.4c gain in F’16 vs a 2.2c dilution in F’17), and a higher tax rate as the Australian off-balance sheet tax losses have been fully recognized (US4-5¢ impact). We also expect to resume accruing for future long term incentive plan benefits.

F’17 EPS is expected to be in the range of US$0.98 to US$1.12.

F’17 will also see increased focus on opportunities for portfolio optimisation. We continually review our existing portfolio in a disciplined way. This will include consideration of options for the Sexual Wellness business and opportunities to enhance our positions in the Industrial and Medical businesses with value-enhancing acquisitions. Goldman Sachs has been retained to assist us in the review of options for the Sexual Wellness business.

ENDS