Results Highlights

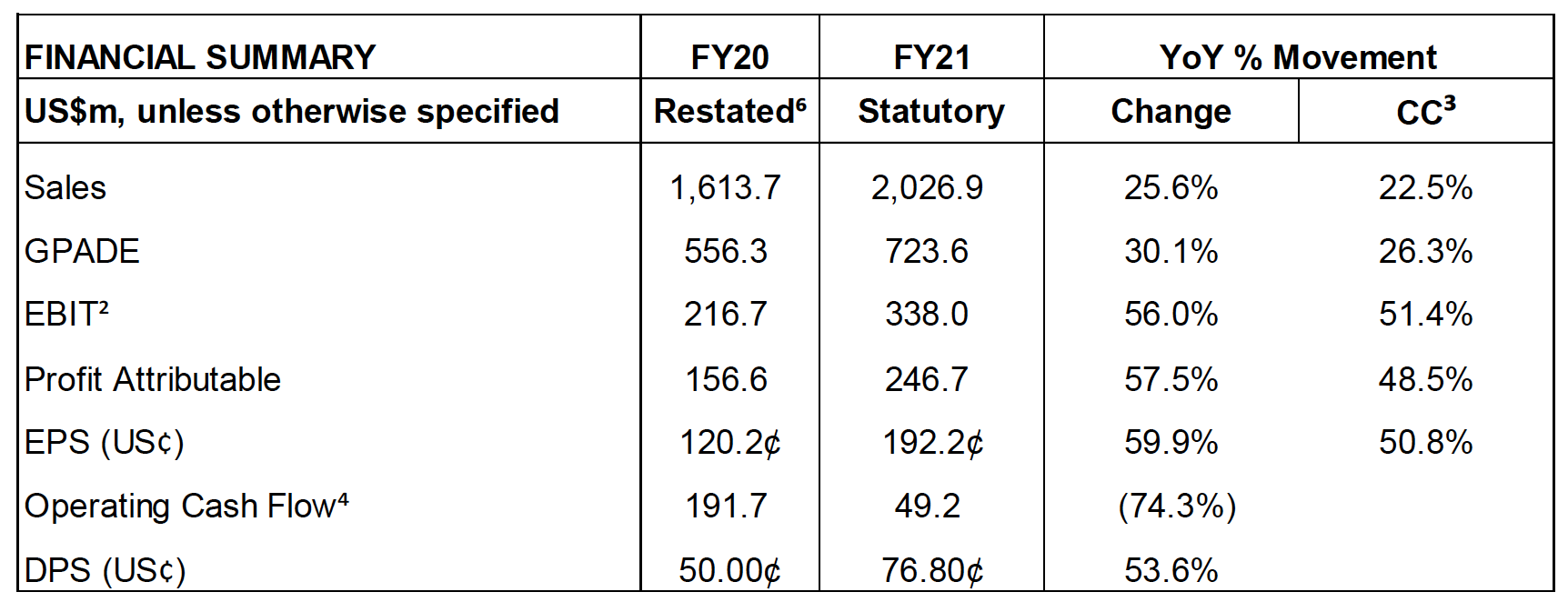

(Please note all amounts in this release are reported in US dollars)- Sales of $2,027m; 25.6% growth and 22.5% Organic Growth¹

- Healthcare Organic Growth¹ of 34.8% with volume growth for Surgical and Life Sciences and favourable pricing/mix benefit for Exam/SU

- Industrial Organic Growth¹ of 7.1% with recovery from Mechanical and continued growth from Chemical

- EBIT² of $338m, up 56.0% YoY and 51.4% on a Constant Currency growth (CC)³ basis. EBIT margin improved by 330bps to 16.7%

- Driven by higher production volumes, pricing/mix benefit and SG&A operating leverage. This was partly offset by elevated labour and freight costs combined with increase in inventory provisions

- Profit Attributable to Ansell shareholders of $246.7m, up 57.5% YoY and 48.5% on a CC basis and EPS of 192.2¢, up 59.9% YoY and 50.8% on CC basis (EPS would have been 193.9¢, without Cloud Computing accounting policy change)

- Operating Cash Flow⁴ generation of $49.2m, temporarily weaker, reflecting increased investment in working capital to support sales growth and higher capital expenditure to expand capacity while achieving ROCE of 19.8%⁵

- Final dividend of US43.6¢ (40% payout), taking full year dividend to US76.8¢ and 53.6% growth over FY20

1. Organic Growth compares FY21 to FY20 Restated revenue at Constant Currency (see below) and excludes the effects of acquisitions and divestments.

2. FY21 EBIT includes $8.1m share of profit from Careplus JV (equity accounted).

3. Constant Currency (CC) compares FY21 to FY20 Restated results translated using FY21 average FX rates; See slide 31 of FY21 Investor Presentation.

4. Operating Cash Flow is defined as net receipts from operations per the Consolidated Statement of Cash Flows adjusted for net payments for property, plant and equipment and intangible assets, repayments of lease liabilities, net interest paid, and tax paid.

5. ROCE is calculated as last 12 months EBIT over average capital employed.

6. FY20 has been restated for change in accounting policy upon adoption of the April 2021 IFRS Interpretations Committee Agenda Decision ‘Configuration or Customisation Costs in a Cloud Computing Arrangement (IAS 38 Intangible Assets)’, which has been applied retrospectively. See slide 29 of FY21 Investor Presentation.

7.Ansell’s financial results are reported under International Financial Reporting Standards (IFRS). This release includes certain non-IFRS measures including EBIT, Operating Cash Flow, Organic Growth and Constant Currency. These measures are presented to enable understanding of the underlying performance of the Company. Non IFRS measures have not been subject to audit or review.

Comments by Ansell Chairman, John Bevan

“The COVID-19 pandemic has continued to be the dominant influence on the global economy this year as countries recover or succumb to new waves. As a result, Ansell’s mission to provide innovative safety solutions in a responsible and reliable manner has never been clearer. This partly contributed to the company upgrading EPS guidance three times throughout 2021 financial year and achieving EPS of 192.2¢.

To meet higher demand for some of our products, we increased our capital expenditure to $82.7m, a 36.5% increase on the prior year. We plan on maintaining the spend at elevated levels for financial year 2022 and are confident that we can deliver the desired returns from these investments. It is important that our shareholders are rewarded and as a result, we have declared a final dividend of US43.6¢ which takes full year dividend to US76.8¢, a 53.6% increase compared to the prior year and a 40% payout ratio. We will also continue to assess share buybacks from time to time as part of our capital allocation strategy.

As we enter the 2022 financial year, we will ensure a well-managed and orderly CEO transition. Magnus has done an excellent job in transforming Ansell and leaves the company in a strong position. Neil will continue to build on this and given his combination of financial and operational experience combined with capabilities for the CEO role, I am highly confident of what the future holds for Ansell.”

Business Review – Comments by Ansell CEO and Managing Director, Magnus Nicolin

“I am pleased to report that Ansell achieved record performance for 2021 financial year with sales of $2,027m, 330bps EBIT margin improvement and 59.9% EPS growth. We saw strong performance from each of our SBUs – Exam/SU and Chemical continued to see COVID-19 related demand whilst Surgical and Life Sciences saw the benefits of successful strategy execution and Mechanical enjoyed improved performance with positive growth in second half of 2021 financial year as the global economy started to rebound from COVID-19 enforced shutdowns.

The focus for us this year has been to continue serving our customers and bringing our major capacity expansions into production despite the challenging operating environment. We were able to get 12 new glove lines and several new body protection smart lines live which helped to deliver the results we saw for 2021 financial year and will also support growth for 2022 financial year and beyond. In addition to this, we ensured that the business is well positioned for the post COVID-19 environment by continuing to invest in our sales force, customer experience, product innovation and digital capabilities.

Ansell remains committed to leading the PPE and Healthcare industries in terms of Sustainability. We continue to monitor labour practices at our own plants and work closely with our suppliers to ensure appropriate labour standards are being employed throughout our supply chain. We are also advancing our work in relation to climate change, completing corporate level scenario analysis to better understand the transitional and physical risks and opportunities whilst also continuing to make investments to help further reduce our environmental impact. Furthermore, we have commenced work to develop a roadmap for Net Zero emissions.

The Company is now a stronger and larger global PPE sector leader with enviable manufacturing, marketing and innovation capabilities thoroughly tested by the extraordinary circumstances of our times. Our strong results are a credit to the 14,000+ people of Ansell. They have maintained a passionate commitment to delivering vital products to satisfy communities in great need. I have never been so impressed by their skills and commitment as I’ve been this year. It’s evident in our results and I thank them.”

Global Business Unit Performance

Healthcare GBU – 61% of revenue and 69% of Segment EBIT

FY21 sales were $1,236.2m, representing 38.2% reported growth and 34.8% Organic Growth. The business saw strong sales growth across all SBUs. Exam/SU and Life Sciences saw favourable pricing/mix impact whilst Surgical and Life Sciences experienced strong volume growth.Exam/SU delivered Organic Growth of 45.2%. Pricing was the main driver as the business successfully passed through cost increases arising from demand and supply imbalance in the industry. Internally manufactured volumes increased in the second half but overall volumes were lower due to supply constraints from outsourced suppliers and a normalisation of demand. Also, second half of last year benefitted from sell through of inventory build pre COVID-19 to clear customer backorders. Surgical & HSS Organic Growth was 13.0% due to market share gains as a result of successful strategy and increased demand with the product also being used outside the surgical setting. Growth in the second half was constrained by supply, particularly for synthetics. Life Sciences saw Organic Growth of 35.3% with positive volume and pricing impact. Performance was aided by the global vaccination drive and good traction with strategic global end users.

EBIT on a reported basis was 75.5% higher than the prior year and margins improved 420bps to 20.1%. This was due to favourable impact from stronger sales (predominately pricing and to a lesser extent mix), higher manufacturing volumes driving greater fixed overhead absorption, reduced waste and SG&A operating leverage. Careplus JV (equity accounted) share of profits contributed $8.1m income. These positive movements were partly offset by increased freight and labour costs.

Industrial GBU – 39% of revenue and 31% of Segment EBIT

FY21 sales were $790.7m, representing 10.0% reported growth and 7.1% Organic Growth. The portfolio saw strong growth from a number of products either due to increased demand from end users seeking additional protection or industry shifts as a result of COVID-19 as well as improving industrial demand stemming from global economic recovery, particularly in the second half.Mechanical Organic Growth was 4.0% where second half performance of 9.2% further improved on first half performance of -1.0%. Multi-Purpose and Electrical Protection gloves remained strong whilst HyFlex® Cut gloves saw better performance in the second half. Chemical experienced 13.0% Organic Growth with strong demand from Chemical Protective Clothing supported by recent capacity investments, albeit growth slowed in second half as it cycled higher year on year comps. It also saw improving performance from Chemical gloves due to industrial recovery and sustained demand from food industries and hygiene protocols remaining in place at work/home.

EBIT on a reported basis increased 21.6% over the prior year and margins improved 140bps to 14.2%. The benefit from stronger sales as a result of higher volume and price increases, plants running at stronger capacity with high overhead absorption, reduced waste and SG&A operating leverage were partly offset by increased costs for freight and labour.

Currency, Cash Flow and Balance Sheet

The net impact of currency movements during the period was favourable to revenue and EBIT by $41.4m and $2.6m respectively. This was primarily due to a general trend of USD weakness with improvement in EURUSD, GBPUSD and CADUSD (revenue currencies), partly offset by MYRUSD (cost currency) as key drivers. FY21 net foreign exchange loss was $11.5m compared to FY20 net foreign exchange gain of $0.5m.Ansell delivered operating cash flows of $49.2m and cash conversion of 60.9%. Operating cash flow was temporarily weaker due to greater investment in working capital to support top line growth along with pricing impact as well as higher capital expenditure to increase capacity in a number of our higher demanded products.

Ansell continues to maintain a strong balance sheet position with conservative gearing profile (net debt/EBITDA of 0.7x) and has access to significant liquidity with no major debt maturities in the next 12 months.

Dividend

A Final Dividend of US43.6¢ (US28.25¢ FY20) per share has been declared. The record date will be 31 August 2021 and the payment date will be 16 September 2021. This takes total dividends for the full year to US76.8¢, a 53.6% increase on the prior year and represents ~40% payout ratio. For non-resident shareholders, the dividend will not attract withholding tax as it is sourced entirely from the Company’s Conduit Foreign Income Account.Dividend Reinvestment Plan (DRP)

The DRP will be available to resident shareholders of Australia, New Zealand and the United Kingdom with an election cut-off date of 1 September 2021. The pricing period will be based on the trading days commencing 3 September 2021 and ceasing on 9 September 2021. No discount will be available.FY22 Outlook

It is likely that COVID-19 will continue to feature throughout FY22 but the impacts will depend on vaccination rates and virus mutations.From a demand perspective, Ansell has a diversified portfolio with products supplying a variety of end markets and geographies. The organisation expects continued demand for Mechanical, Surgical, Life Sciences and internally manufactured Single Use gloves. However, lower demand is expected in areas which benefited most during the onset of COVID-19 i.e. Chemical Body Protection and undifferentiated Exam/SU gloves. Pricing is expected to feature throughout FY22, positively and negatively.

From a supply perspective, recent capacity investments should support sustained demand. However, increased COVID-19 cases in South East Asia in the recent months may disrupt supply. A number of Ansell’s factories and suppliers in the region have had short term closures or reduced operations. This may impact sales during FY22 H1. Increased freight costs and shipping delays are also expected to persist throughout FY22.

It is anticipated that net interest expense will be in the range of $20.0m-$21.0m and the effective tax rate will be in the range of 22.0-23.0%. There will be increased software investments in FY22 where a portion will now be immediately expensed rather than capitalised and amortised pursuant to the new cloud computing accounting policy resulting in 5¢-6¢ adverse EPS impact.

As a result, FY22 EPS is expected to be in the range of 175¢ to 195¢.

FY21 Results Webcast

Magnus Nicolin (Managing Director and Chief Executive Officer), Zubair Javeed (Chief Financial Officer) and Neil Salmon (President of Industrial Global Business Unit and Incoming Managing Director and Chief Executive Officer, effective from 1 September 2021) will host a webcast at 8:00am Australian Eastern Standard Time on Tuesday, 24 August 2021 (equivalent to 12:00am Central European Summer Time 24 August 2021 and 6:00pm Eastern Daylight Time 23 August 2021) to discuss the results.To listen to the webcast, please visit Ansell’s Investor Relations website www.ansell.com/au/en/about-us/investor-center. Alternatively, please click on the following link https://onlinexperiences.com/Launch/QReg/ShowUUID=E4E92A71-64B5-4D70-AABD-38E524BC8631&LangLocaleID=1033.

ENDS