ANSELL LIMITED HALF YEAR FY23 RESULTS & UPDATED FY23 GUIDANCE

14 February 2023 – Ansell Limited (ASX:ANN), a global leader in personal protection safety solutions, today announces financial results for the half year ended 31 December 2022.

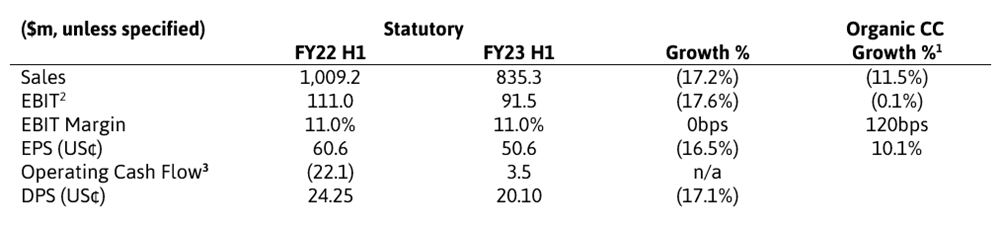

FY23 H1 Results Highlights (Please note all amounts in this release are reported in US dollars)

- Sales of $835.3m. Strong growth in Industrial more than offset by lower Healthcare sales leading to an overall 11.5% decline on an organic constant currency-basis1. On a reported-basis, sales declined 17.2%.

- Healthcare GBU sales declined 21.9% on an organic constant currency-basis1. Continued strong performance in Surgical was more than offset by planned price reductions in Exam/SU and weaker market conditions including the impact of customer destocking affecting demand for Exam/SU and Life Sciences products.

- Industrial GBU organic constant currency1 growth was 6.4%, with strong performances in North America and emerging markets. Mechanical grew sales in all regions and Chemical returned to growth after a period impacted by declining pandemic demand for disposable protective clothing.

- EBIT2 of $91.5m. EBIT margin improved 120 basis points on an organic constant currency-basis1 basis, with Healthcare margins increasing substantially after being negatively affected by the sell through of high-cost Exam/SU inventory of outsourced finished goods in the prior period.

- EBIT was 0.1% lower on an organic constant currency-basis1, and declined 17.6% on a reported-basis due to the exit from Russia in FY22 and unfavourable FX changes.

- Earnings Per Share of US50.6¢ improved 10.1% on an organic constant currency-basis1 and were 16.5% lower on a reported-basis.

- Operating Cash Flow3 of $3.5m; supporting higher inventory and continued investments in capacity expansion and business process improvements.

- Interim Dividend of US20.10¢ resulting in a payout ratio of 40%, consistent with Ansell’s dividend policy.

1. Organic Constant Currency (CC) Growth compares FY23 H1 to FY22 H1 at Constant Currency and excludes the effects of acquisitions, divestments and business exits including Russia in FY22

2. FY22 EBIT includes share of loss from Careplus JV (equity accounted)

3. Operating Cash Flow is defined as net receipts from operations per the Consolidated Statement of Cash Flows adjusted for net payments for property, plant and equipment and intangible assets, repayments of lease liabilities, net interest paid, and tax paid

Commenting on Ansell's FY23 H1 Results, Managing Director and CEO Neil Salmon said:

"We have made good progress so far this fiscal year against our most important strategic and operational objectives in market conditions where forward visibility remains limited.

The performance of our Industrial GBU was particularly pleasing, with strong results in our Mechanical portfolio and improving trends in our Chemical portfolio. Previous acquisitions and successful new product innovation over several years have broadened the market verticals in which the Mechanical business is well positioned. Our enhanced position in energy and electrification grew strongly in the half and new products, particularly in cut protection, gained traction. This more than offset a decline in gloves supplied to the warehousing and logistics sector as customers normalised inventory levels and business activity quietened following a period of elevated pandemic demand.

The Healthcare GBU continued to record strong growth in sales of Surgical gloves. However, we saw destocking trends previously evident primarily in medical end markets extend more broadly into other markets with impacts on our Exam/SU products sold into industrial settings and Life Sciences. This was due to a combination of customers becoming cautious on economic conditions while growing more comfortable to reduce inventory as supply chain pressures have eased and product availability has broadly improved.

Compared to the first half of FY22, EBIT was negatively affected by the stronger US dollar and the absence of a profit contribution from our exited Russian operations. Adjusting for these factors, we were able to improve our EBIT margin by 120 basis points. This was assisted by Healthcare EBIT margin normalising with high-cost Exam/SU inventory now sold through. Industrial EBIT margin was lower than expected, largely due to the timing of price increases and cost increases in Chemical, however we expect improvement in Industrial margins as the fiscal year progresses.

Our focus on investing for long-term growth and value creation remains unchanged. Construction of our Kovai Surgical facility in India continues and is on track for manufacturing commencement in FY24. Our focus on R&D and product innovation continues and as part of this we are now placing renewed emphasis on innovation in the Exam/SU business as we move past the significant supply chain disruptions experienced by this business over the past three years. Availability of critical resources that were previously focused on continuity of supply and our new manufacturing capability including the recently announced buyout of our Careplus joint venture partner are key enablers to innovation in Exam/SU. Full control over Careplus, an increasingly important manufacturing facility for Ansell, will also help protect the intellectual property behind new innovations.

Improving our internal systems and businesses processes remains a key priority, with two more of our manufacturing facilities in the process of receiving ERP upgrades. Advances were made in our customer-facing digital capabilities including our myAnsell customer portal and our e-commerce marketplace presence. We remain focused on delivering on our sustainability commitments, with a key highlight in the half being confirmation from all of our Malaysian finished goods suppliers that they have completed their recruitment fee reimbursement programs for currently employed migrant workers."

Global Business Unit Segment Performance

Healthcare GBU – 56% of revenue and 57% of GBU EBIT

FY23 H1 sales were $467.0m, representing declines of 21.9% on an organic constant currency-basis1 and 26.1% on a reported-basis. Organic constant currency1 growth in Surgical was more than offset by declines in Exam/SU and Life Sciences.

Surgical achieved organic constant currency1 growth of 17.7%, continuing its recent trend of strong performance with a tailwind in the half from some customer stock building in North America and back order recovery. With competitors no longer supply constrained and customers well stocked, growth in Surgical is expected to moderate through the back half of the year. Exam/SU declined 38.1% on an organic constant currency-basis1, with reductions in both price and volume as customers continued to work through excess inventory accumulated during the height of the pandemic. This inventory drawdown broadened through the half to include our differentiated, industrial-grade TouchNTuff® range. Our overall prices and unit margins remain significantly higher than pre-COVID, benefiting from a favorable mix shift to our more differentiated products produced in-house. Life Sciences declined 15.3% on an organic constant currency-basis1, with key distributors reducing stock levels following easing of supply chain pressures, particularly in EMEA and APAC.

EBIT improved 11.3% on an organic constant currency-basis1, with EBIT margin increasing to 12.0%. Growth was assisted by expected reductions in costs from outsourced suppliers in Exam/SU and an improvement in performance from the Careplus JV which broke even towards the end of the half. On a reported-basis, EBIT contracted 12.2% due to adverse FX and the loss of earnings from our exited Russia business.

Industrial GBU - 44% of revenue and 43% of GBU EBIT

FY23 H1 sales were $368.3m, an increase of 6.4% on an organic constant currency-basis1 and a decline of 2.3% on a reported-basis. Positive organic constant currency1 growth was achieved in both Mechanical and Chemical.

Organic constant currency1 growth in Mechanical was a strong 7.6%, benefitting largely from pricing and mix. Growth was delivered in all regions, including double-digit growth in emerging markets. Cut and Specialty portfolios performed well, with sales of new HyFlex® Intercept™ styles boosting Cut and Specialty assisted by significant growth of Ringers® products into energy markets. Chemical grew 2.9% on an organic constant currency-basis1, returning to growth following two halves of contraction as pandemic-induced demand for disposable protective clothing subsided. Demand for disposable clothing remains suppressed due to high customer inventory levels, however price-led growth in our hand-protection range acted as on offset.

EBIT declined 12.8% on an organic constant currency-basis1 and 24.0% on a reported-basis. A large component of the reported decline was due to unfavourable FX and the loss of earnings from our exited Russia business. While sales growth was strong, earnings fell. We secured targeted price increases however these were insufficient to offset higher than expected inflation in plant costs, particularly in Chemical. Chemical margins were also subdued due to continued competitive intensity in the disposable clothing segment. Further price increases are targeted, and we also anticipate a moderation in cost pressures in coming months with an improvement in margins anticipated as a consequence in the second half.

Currency, Cash Flow and Balance Sheet

The impact of currency movements was unfavourable to revenue by $48.0m and unfavourable to EBIT by $13.8m. The strengthening of the USD against the EUR and other key revenue currencies was only partially offset by corresponding weakness in major cost currencies. The unfavourable impact of FX to EBIT included a net foreign exchange gain on hedge contracts of $7.2m, the equivalent number in FY22 H1 was a loss of $0.9m.

Operating Cash Flow was $3.5m for the half with adjusted cash conversion of 64.9%, improving from 59.7% in FY22 H1. Investment in working capital totaled $49.5m, with inventory expanding due to increasing Surgical and Mechanical safety stock levels and higher than expected inventory in differentiated Exam/SU and Life Sciences product categories where demand was lower than expected due to customer destocking. Operating Cash Flow continues to support investments in manufacturing capacity with construction of our greenfield Surgical manufacturing facility in India progressing well.

Our balance sheet remains strong and conservatively geared (net debt/EBITDA of 1.1x).

In December we renewed our on-market share buyback program for a further twelve months. We intend for the buyback program to remain active in the second half of FY23, subject to the opportunity to acquire shares at appropriate prices.

Dividend

An interim dividend of US20.10¢ per share has been declared. The dividend will be unfranked, and represents a 40% payout ratio which is consistent with Ansell’s dividend policy. The record date will be 21 February 2023 and the payment date will be 9 March 2023. For non-resident shareholders, the dividend will not attract withholding tax as it is sourced entirely from the Company’s Conduit Foreign Income Account.

Dividend Reinvestment Plan (DRP)

The DRP will be available to resident shareholders of Australia, New Zealand and the United Kingdom with an election cut-off date of 22 February 2023. The pricing period will be based on the trading days commencing 24 February 2023 and ceasing on 2 March 2023. No discount will be available.

FY23 Outlook

The Industrial GBU delivered a strong organic constant currency1 sales result in the first half, and we believe that economic conditions will support continued organic constant currency1 growth in this business in the second half.

Demand conditions in our Healthcare GBU are weaker than previously expected. Distributor demand in the first half reflected the impact of destocking in Exam/SU and Life Sciences. We expect this impact to moderate in the second half, however the timing of this moderation is delayed versus our earlier assumptions. Our Surgical business benefited in the first half from a recovery in back orders and a rebuild of inventory by channel partners particularly in North America. These trends, combined with a challenging environment for healthcare systems globally and improved competitor supply, are expected to be less favorable to Surgical demand in the second half.

With a high percentage of our currency volumes hedged, changes in FX rates are not likely to materially alter earnings through the rest of FY23. Our practice of hedging against FX movements means FY23 is forecast to benefit from a $11m to $15m gain on FX contracts entered when the USD was weaker, helping to cushion the impact from a stronger USD in the current year.

Our book tax rate for the full year is expected to be in the range of 20.5% – 21.5%. This includes some help from being able to offset gains on FX contracts in Australia against unbooked losses, partially offset by the increase in the Sri Lanka corporate tax rate enacted on 19 December 2022 and brought into effect retrospectively from 1 October 2022. With gains on Australian FX contracts expected to reduce and a full year impact of the higher Sri Lanka corporate tax rate, we are expecting our book tax rate to increase to 22.5% – 24.5% in FY24.

With consideration to the above factors, we are revising our FY23 EPS guidance from the original range of US115¢ – US135¢ to a new range of US110¢ – US120¢.

FY23 H1 Results Webcast

Neil Salmon (Managing Director and Chief Executive Officer) and Zubair Javeed (Chief Financial Officer) will host a webcast at 8:00am Australian Eastern Daylight Time on the day of the release (equivalent to 10:00pm Central European Time 13 February 2023 and 4:00pm Eastern Standard Time 13 February 2023) to discuss the results.

To listen to the webcast, please visit Ansell’s Investor Relations website. Alternatively, please click on the following link.

This announcement was authorised for release by the Board of Directors of Ansell Limited.

ENDS