Investment in Business Transformation and M&A position Ansell for Sustainable Growth

18 February, 2019 – Ansell Limited (ASX:ANN), a global leader in safety solutions, today announces half-year results for the period ending 31 December 2018.

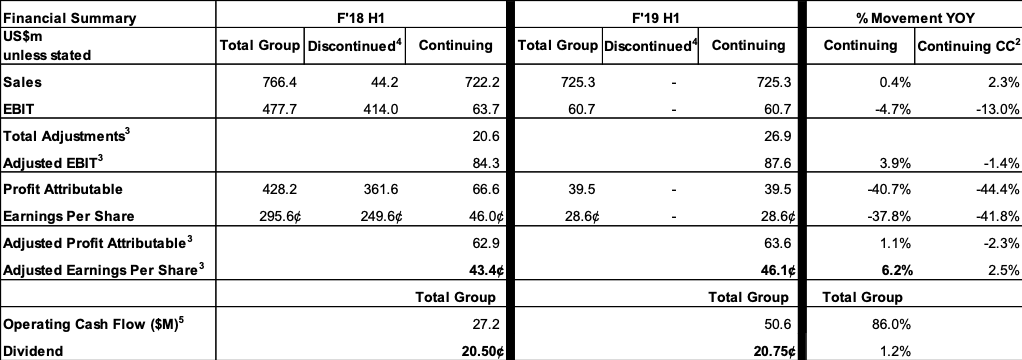

Results Highlights (Please note all amounts in this release are reported in US dollars)

- Sales of $725.3m; continuing operations up 0.4% YOY while organic sales¹ up 2.1% in constant currency (CC)²

- Healthcare organic sales growth¹ 3.8%. Industrial 0.3%, following soft Q1, improved Q2

- EBIT of $60.7m. Adjusted EBIT³ of $87.6m, up 3.9% YOY

- Adjusted Profit Attributable³ of $63.6m, up 1.1% YOY including impact of higher effective tax rate

- EPS of US28.6¢, down YoY on expenses from Transformation Program and absence of one-time tax benefits in F’18 H1

- Adjusted³ EPS of US46.1¢ up 6.2%

- Total Group Sales & EBIT lower on divestment of Sexual Wellness (“SW”) with prior year Group EBIT including pre-tax gain on SW sale of $411m

- Strong operating cash flow generation of $50.6m up 86% YOY

- Increased half year dividend to US20.75¢

1. Organic growth compares F’19 H1 to F’18 H1 results at Constant Currency (see below) and excludes the effects of acquisitions, divestments and exits.

2. Constant Currency (CC) compares F’19 H1 to F’18 H1 results restated at F’19 H1 average FX rates and excludes the value of FX gains or losses in both periods. See Slide 35 of F’19 H1 Investor Presentation for additional information.

3. Adjusted EBIT and EPS in F’19 H1 excludes transformation costs. Adjusted EBIT in F’18 H1 excludes a.) transformation costs and b.) impact of change of estimating useful life on product and technology development costs to generally expense as incurred. Together, these are Total Adjustments. Adjusted Earnings Per Share, excludes Total Adjustments. Adjusted F’18 EPS also excludes the deferred tax revaluation following corporation tax rate changes (primary impact in US). See Slide 23 of F’19 H1 Investor Presentation for further details.

4. Discontinued operations include results of the Sexual Wellness business, and the gain on sale on divestment as of 1 September 2017

5. Operating Cash Flow means net cash provided by operating activities per the Consolidated Statement of Cash Flows adjusted for net expenditure on property, plant, equipment, intangible assets and net interest.

Comments by Ansell Chairman, Glenn Barnes

“Ansell continued to invest in strategic growth initiatives to position the company for sustained growth into the future. This was in an environment where profit growth was temporarily constrained by higher raw material costs. The transformation program continues to be well executed and the Company now expects to exceed the original savings targets. We are committed to a balanced capital deployment program having completed the $265 million buyback originally announced in May 2017 while undertaking a disciplined approach to M&A investment and in capital projects to drive growth and productivity.

The strength of Ansell’s balance sheet and cash flow generation was recently recognised by Moody’s with an upgrade to our investment grade credit rating. We are well positioned for further value adding capital management activities. With an increase announced to our interim dividend we are on track for an increase in the full year dividend to shareholders for the 16th year in a row. We have an ongoing share buyback program (as approved at the 2018 AGM) and the company expects to continue active capital deployment on a combination of acquisitions and share buybacks.”

Business Review – Comments by Ansell CEO and Managing Director, Magnus Nicolin

“Ansell’s fiscal year 2019 started amid some challenging external headwinds, including rising costs of raw materials, risks of US import tariffs, and some emerging areas of demand uncertainty in the EMEA automotive sector and in select emerging markets including Russia and Brazil. We have successfully navigated these challenges and have seen improving trends through the half in both organic revenue growth and margin. This, coupled with continued strong delivery against the transformation objectives, puts Ansell in a strong position to achieve further top and bottom line growth in the second half.

Overall organic revenue growth at 2.1% was below our targeted 3-5% range, with the shortfall arising from the impact of the demand factors mentioned above on our Industrial GBU. At the same time, it was pleasing to see strengthening performance in North America Industrial as we continued to gain share through our channel partnerships, while the Healthcare business also delivered generally improved organic revenue growth of 3.8%.

The team has responded well to the margin challenges arising from increases in key raw material categories and US import tariffs. We have substantially mitigated the tariff impact, while price increases started to take effect from October with continued increases expected to come into effect through the third quarter. The target remains to offset raw material cost inflation in the second half results.

Ansell also achieved major milestones in our transformation program, closing two manufacturing facilities in Mexico and one in Korea while significantly expanding our facilities in Vietnam, Sri Lanka and Malaysia. I have been particularly pleased with the completion of our significant investment in Vietnam and the very strong performance of this site as it ramps up to achieve its increased production targets across a much wider range of differentiated product technologies. With this phase of the transformation program complete and results running ahead of expectation, we have increased our annual savings target to $35m by F’20, up from the original target of $30m.

Our Healthcare business performed well throughout the half despite temporarily lower margins from the impact of raw material cost inflation. This was anticipated prior to the full implementation of price increases that will be evident in the second half. Top line growth came from improving trends in our Surgical business and strong results in both our Life Science and Single Use/Exam businesses.

We remain active in evaluating M&A opportunities against both strategic fit and value creation criteria. We have successfully closed two acquisitions since our F’18 year end results. In October our Healthcare GBU, acquired Digitcare, an $8m US company with a differentiated single use product range targeted to emergency response services. On 1 February 2019, we announced and closed the $70m acquisition of Ringers Gloves, a leading specialist player in Industrial impact protection gloves. Impact protection is important to meeting the safety needs of many of our existing mechanical and oil and gas customers and Ansell has been significantly underrepresented in this category in the past.

As we have shown with the BSSI, Nitritex and Microgard® acquisitions, we have the ability to leverage our strong global sales and supply chain position to achieve accelerated global growth in the product ranges of smaller previously regionally focused companies. I am confident that we will deliver similar benefits as we integrate Ringers and Digitcare into the Ansell network. Overall, I am very pleased with the progress achieved in the business in the last few months and I believe we are well positioned to deliver strong results in the second half of F’19 and beyond. Accordingly, we now expect adjusted EPS for F’19 to be delivered within the upper half of our previous guidance range.”

Global Business Unit Performance

Healthcare GBU – 52.8% of revenue and 54.6% of Segment EBIT

Sales grew 4.2% in constant currency including the contribution of the Digitcare acquisition in F’19 H1. Organic revenue growth was 3.8% excluding acquisition benefits arising from 15.4% growth in new product sales, and 2.8% growth in sales to emerging markets.

Exam/Single Use sales increased 4.0% on growth in industrial and medical non-acute applications. Life Science sales were up 9.3%. Surgical and Safety Solutions growth of 1.9% is inclusive of 18% growth in our Synthetic Surgical portfolio offsetting a decrease in lower margin powdered surgical gloves.

Adjusted EBIT³ in constant currency was 7.5% lower on prior year, due to the impact of higher raw material costs and the weighting of Exam/Single Use at lower margins (than Surgical). We are expecting margin improvement in F’19 H2 due to price increases and mix. On a reported basis, sales were up 2.8%, with Adjusted EBIT³ down 8.2%.

Industrial GBU – 47.2% of revenue and 51.6% of Segment EBIT

Sales increased 0.2% in constant currency whilst organic revenue growth was up 0.3%. This lower growth rate was due to the deceleration of European market demand resulting from challenges in the automobile sector and emerging market declines in countries such as Russia, Turkey and Brazil. These headwinds moderated during the half with improving trends in the second quarter. US Industrial sales delivered 6% growth, with 8% growth in sales through our channel partners, an important contributor. Ansell innovative technologies continue to provide differentiated solutions for customers across global markets as seen in continued strong growth in HyFlex® Intercept™.

Mechanical sales growth of 2.1% was impacted by the factors mentioned above, with European deceleration offsetting a strong US performance. Chemical sales decline of 1.5% was due to reduced sales of lower end chemical gloves and significant customer destocking effects on household gloves sold to retail. With a new partnership agreement in place, we expect to return to growth in H2. The chemical clothing range continued to see robust Microgard® growth as we expand this product range globally.

Adjusted EBIT³ benefited from strong product mix, transformation cost benefits and pricing actions offsetting higher raw material costs. On a reported basis, sales were down 2.1%, with Adjusted EBIT³ up 17.7%.

Adjustments to EBIT

Adjusted EBIT and EPS for F’19 H1 exclude the costs associated with the transformation program announced in July 2017 ($26.9m pre-tax). This is consistent with prior reporting and EPS guidance. Adjusted EBIT and EPS for F’18 H1 also exclude the costs associated with the transformation program and in addition exclude two major non-cash non-recurring items as detailed on Slide 23 of the F’19 H1 Investor Presentation.

Currency, Cash Flow, Taxation and Financing

The impact of currency was unfavorable to revenues by $13m, primarily on a weakening Euro vs USD. FX was moderately favorable to EBIT with $3.1m net gains on currency hedging.

Operating cash flow generation of $50.6m was higher than last year’s $27.2m by 86%. This was due to higher net receipts on improved accounts receivable as well as lower taxes and interest costs. This 86% improvement is after transformation cash expenditure of $11.3m.

The Company’s net debt: EBITDA ratio of 0.5x, remains well below targeted leverage ratio levels. Strong liquidity allows a continuation of share buybacks, accelerated capital investment and value accretive M&A.

The current share buyback program was active in purchasing ~9.7m shares at a cost of $168.8m during F’19 H1. Total share purchases to date under the original $265m program (announced in May 2017) are ~15.1m at an average price of A$23.42 per share.

Dividend

An Interim Dividend of US20.75¢ (US20.50¢ F’18 H1) per share has been declared. The record date will be the 25th February, 2019 and the payment date the 14th March, 2019. For non-resident shareholders, the dividend will not attract withholding tax as it is sourced entirely from the Company’s Conduit Foreign Income Account.

Dividend Reinvestment Plan (DRP)

The DRP will be available to resident shareholders of Australia, New Zealand and the United Kingdom with an election cut-off date of 26th February, 2019. No discount will be available.

F’19 Outlook

F’19 EPS for Ansell’s continuing businesses is now expected in the range of 106¢ -112¢. This compares to the Company’s original guidance range of 100¢ -112¢. Improved EBIT to Sales Margins are expected in the second half of F’19 with the benefit of selling price increases plus the realisation of cost savings from the transformation program. Success with these initiatives plus the benefits of the share buyback program are contributing to the revised EPS guidance range. The revised range includes a 4¢ benefit from the buyback completed in F’19 H1 and includes the expected initial 1c dilution from the Ringers Gloves acquisition.

The new guidance range continues to exclude the ongoing costs from our investment in the transformation program. P&L cash costs of the transformation program are estimated at $27-31m in F’19. The total P&L impact of the transformation programme is expected to include $20m in non-cash fixed asset write-downs and pre-tax P&L cash expenses estimated at $52-57m.

|

For further information: |

|||

| Investors & Analysts | |||

| Australia | Jocelyn Petersen, IR | Tel: +61 3 9270 7160 / +61 422 005 994 | jocelyn.petersen@ansell.com |

| Belgium | Neil Salmon, CFO | Tel: +32 2 528 75 59 | neil.salmon@ansell.com |

| Media | |||

| Australia | Tim Duncan, Hintons | Tel: +61 3 9600 1979 / +61 408 441 122 | tduncan@hintons.com.au |

| US | Tom Paolella | Tel: +1 732 345 2167 | tom.paolella@ansell.com |